Aca Requirements For Seasonal Employees

Employs 50 or more full-time equivalent workers. Under the ACA seasonal employees include those who generally begin work at the same time of year and their employment is no longer than 6 months.

Impact Of The Affordable Care Act On The Staffing Industry

For a worker to be a seasonal employee they need to work in a position for which the customary yearly employment is a maximum of 120 days.

Aca requirements for seasonal employees. By and large most of the laws concerning healthcare for seasonal employees and the ACA only apply to employers considered large under the rules of the IRS. Unfortunately weve heard first hand from many of our clients that their Affordable Care Act compliance responsibilities tend to slip during the summer months following the push to submit annual ACA information filings to the IRS. The caveat is that the seasonal worker had a minimum gap of 13 weeks between stints of employment with the same company.

Aca requirements for seasonal employees Written by Arthur Tacchino JD Chief Innovation Officer on August 26 2020. Determining eligibility for seasonal employees with the ACA. This means you do not have to classify the individual as full-time benefits eligible subject to the benefits waiting period if.

An employer is not considered an ALE if the employers workforce exceeds 50 full-time employees including full-time equivalent employees employees who work 130 hours a month for 120 days or fewer during the preceding calendar year and all of the employees in excess of 50 who were employed during that period of no more than 120 days were seasonal workers. Employees who are reasonably expected to average at least 30 hours per week and are hired into positions expected to continue for less that 12 months but not including seasonal employees must be treated as though they would be employed for the full initial measurement period. Customary refers to the nature of the position the employee typically works for six months or fewer.

In that case your business is not subject to the Affordable Care Acts mandate to provide health insurance. Seasonal workers that work 120 or fewer days during all of 2014 are not counted for purposes of determining whether the company is a large or small employer in 2015. Examples include summer lifeguards and retail employees during the busy holiday months.

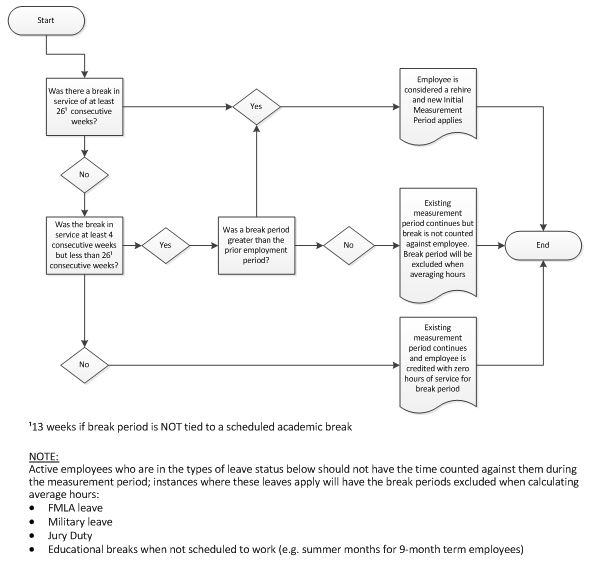

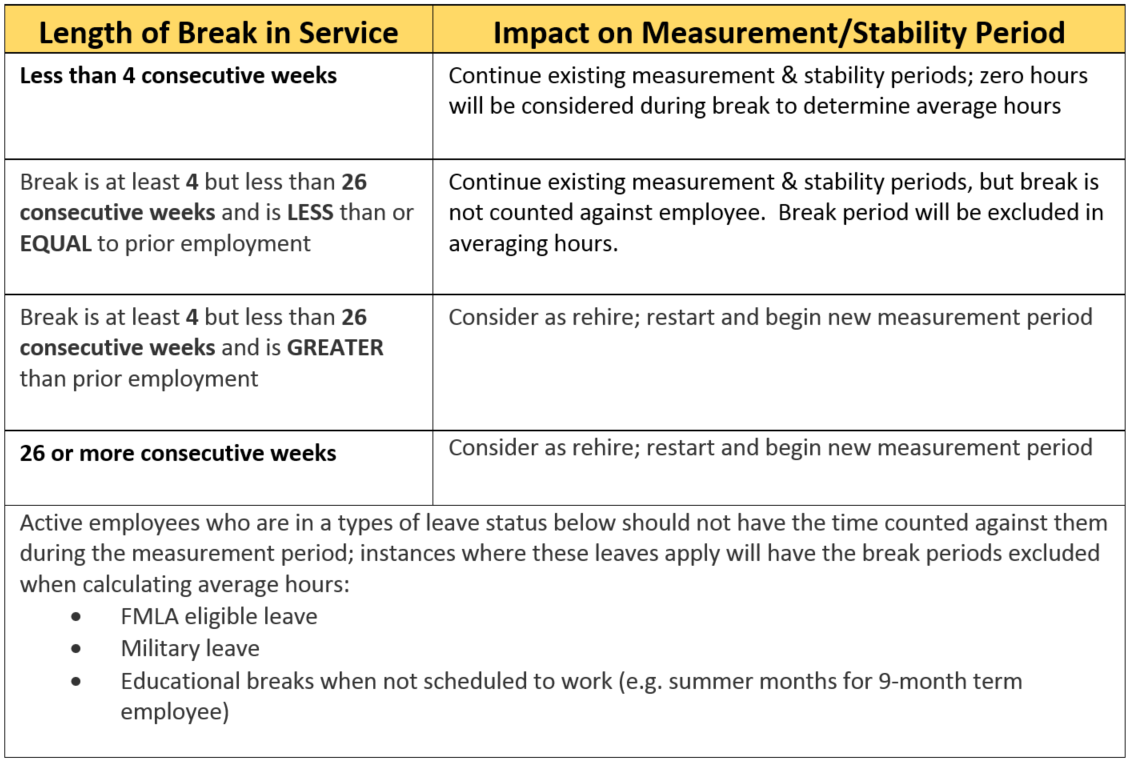

Seasonal workers can cause significant problems for employers because of the new requirements of the Affordable Care Act ACA. Employers are not required to include seasonal workers or employees who have health coverage under TRICARE or a VA health program in the full-time equivalent calculation. The ACA allows large employers to begin a new initial measurement period for returning seasonal employees each year.

The period of employment must begin at about the same time each calendar year such as winter or summer. How to Determine Company Requirements Under ACA by Joseph A. As outlined by the Society for Human Resource Management a company that employs 50 or more people is considered a.

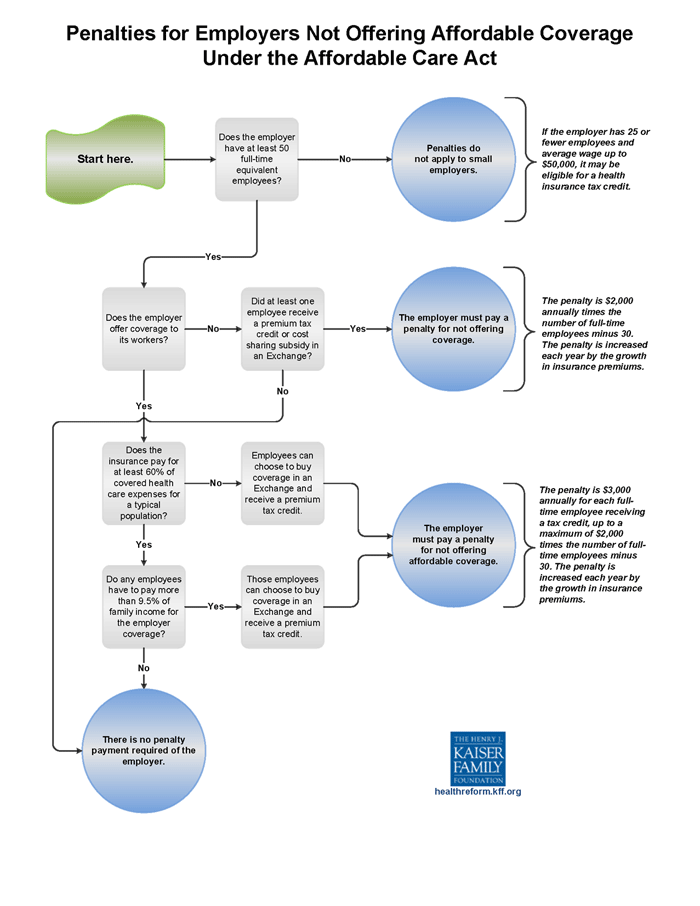

Many employers rely on seasonal workers. If you hire summer interns at the same time each year it is a good sign they are seasonal employees. The treatment of seasonal workers is one of those items that can easily be overlooked by applicable large employers ALEs those organizations that have 50 or more full-time or full-time equivalent employees that are required to extend offers of affordable minimum essential coverage to at least 95 of their ACA full-time workforce or be subject to penalties under the employer shared.

Aca requirements for seasonal employees 3 minute read. Retains those employees for 120 days or less per year or four full non-consecutive months Classifies employees 50 51 52 and so on as seasonal employees. Bucci Jr GBAC Inc.

With educational organizations the minimum gap jumps to. Your company is an ALE if you have 50 or more full-time equivalent FTE employees. What are ACA seasonal employees.

Seasonal employees and the ACA The Affordable Care Act ACA requires applicable large employers ALEs to offer health insurance to their full-time employees. As a member of CEMA it is fair to say that the winter season is such a time for. Navigating reporting with multiple different types of employee working hours can be quite challenging.

If you answered Yes to both questions above your employee is a seasonal employee regardless of how many hours the employee is expected to work each week. The following article is adapted from the Connecticut Energy Marketers Association CEMA Pipeline newsletter with the permission of the Association and GBAC. While the FLSA doesnt require a certain number of hours to determine full-time status the ACA does.

Pin By Agaja Dabner On Opm Gov Dental And Vision Insurance Employee Health Health Insurance Coverage

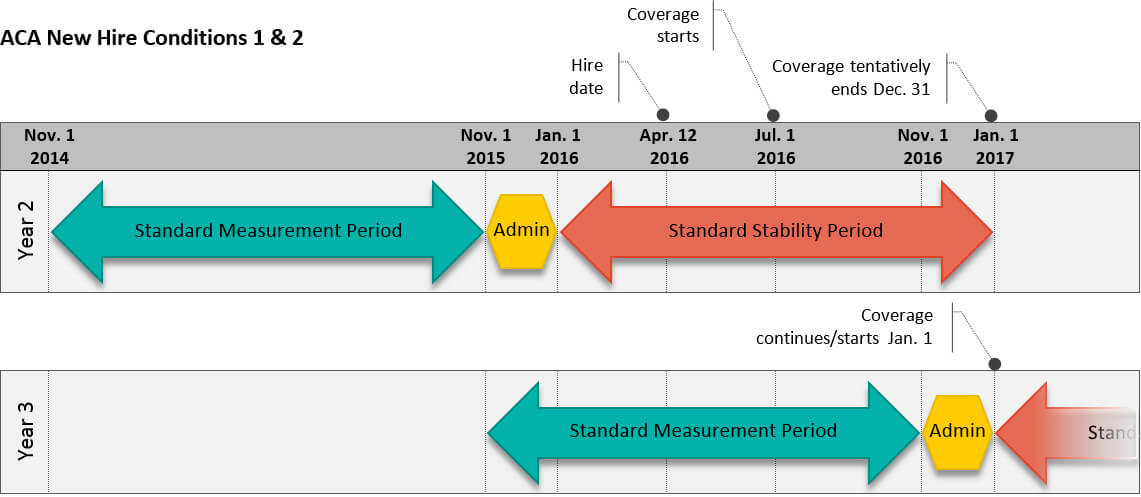

The Aca Look Back Measurement Method

In Spite Of Being Aware Of The Hipaa Rules And Regulations Several Cases Of Violatio Health Information Management Medical Coding Training Medical Social Work

Measuring Aca Eligibility Through The Look Back Method Health E Fx

Avoid Penalties Under Obamacare For Tax Year 2020 Integrity Data

Pin On Tax Accounting Infographics

Https Performancehcm Com Wp Content Uploads 2017 07 Aca Waiting Period Tig Performancehcm Pdf

The Patient Protection And Affordable Care Act Aca Uni Human Resource Services

The Aca Look Back Measurement Method

Impact Of The Affordable Care Act On The Staffing Industry

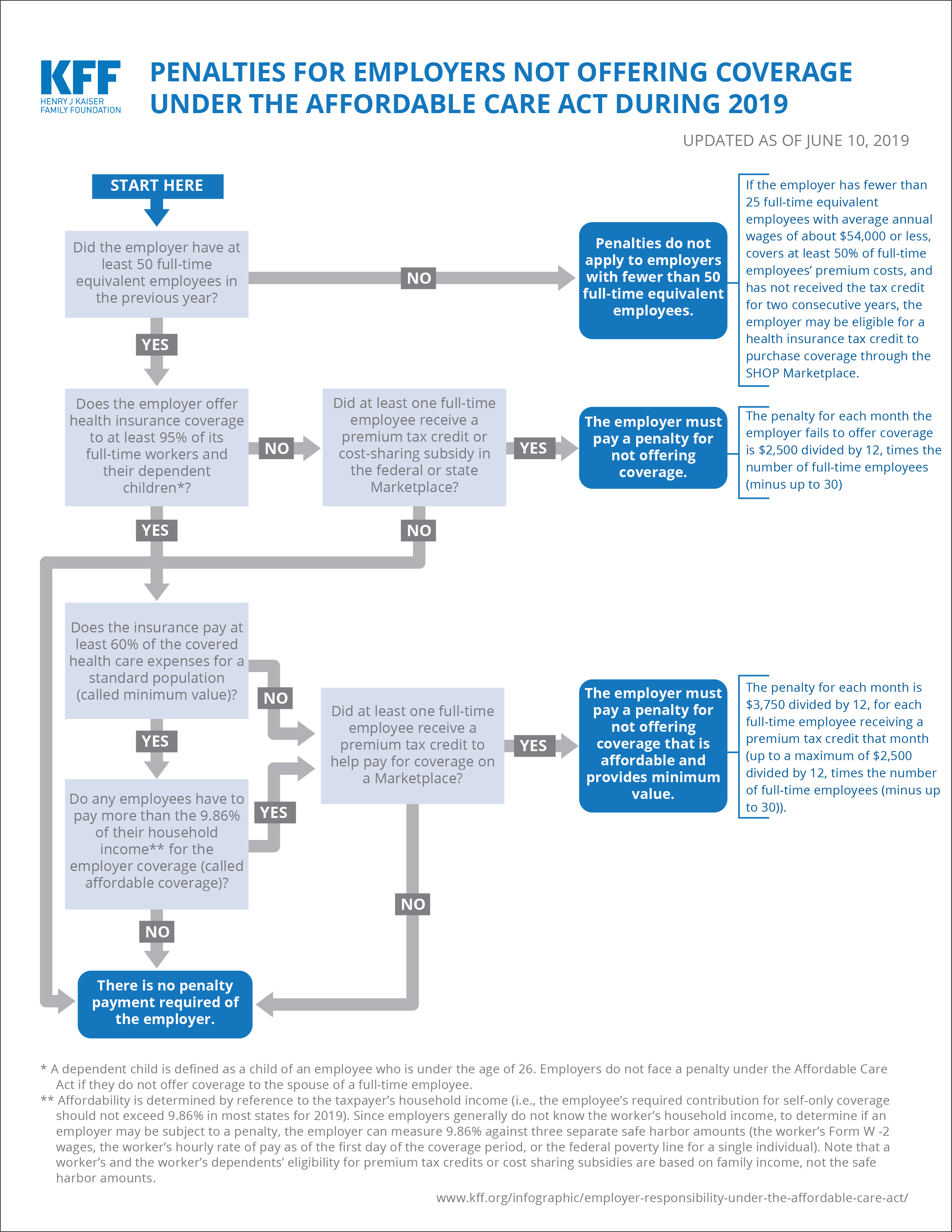

Employer Responsibility Under The Affordable Care Act Kff

A Formula To Calculate Whether Or Not Your Business Is Large And Subject To The Employer M Buy Health Insurance Health Insurance Quote Health Insurance Plans

Health Insurance Requirements For Employers With Interns Temporary Workers Onedigital

The Aca Look Back Measurement Method

Aca Frequently Asked Questions For Administrators Uw System Human Resources

Post a Comment for "Aca Requirements For Seasonal Employees"